In a recent study, local authorities in UK have been ranked according to their average house prices this year. Remarkably, two out of the top five most affordable places to purchase a house are nestled within the vibrant surroundings of Lancashire. In the face of constant inflation rises, securing a mortgage offer that is both affordable and reasonable has become an increasingly challenging task especially for first-time buyers. This difficulty has led to many individuals either postponing their plans of moving out altogether or resorting to renting. This further highlights the pressing need for accessible housing solutions.

Responding to this ongoing change, here at the leading roof sheet manufacturer Cardinal Steels, in collaboration with our digital marketing agency, we have created this comprehensive report. Which evaluates and ranks recent data from various areas across the UK based on the average house prices. Our aim is to shine a light on the best and worst areas for buying a property. Therefore, providing prospective homebuyers and investors with valuable insights into navigating the ever-changing housing market.

Top 5 Cheapest Areas To Buy A House

1. Burnley – £101,820

Nestled in the heart of Lancashire, Burnley claims the top spot as the best area to buy a house, boasting an impressively affordable average house price of £101,820 this year. Burnley’s housing market stands out with a remarkable margin of over £20,000 compared to the second-ranking area, making it an even more enticing area for prospective homebuyers.

2. Hyndburn – £123,237

Another good area in the Lancashire region is the town of Hyndburn which secures its place on the list with an average house price of £123,237. This not only reinforces the town’s appeal but also reflects a proactive response to the evolving dynamics of the housing market.

3. Hartlepool – £123,710

The seaside and port town Hartlepool, situated in County Durham, emerges as the third most affordable area to buy a house, boasting an average price of £123,710. This is considerably lower than other areas, reinforcing Hartlepool’s resilience as an affordable housing option within England.

4. Durham – £125,367

Venturing beyond Lancashire, County Durham secures its place as one of the cheapest areas in England to purchase a house, presenting an average price of £125,367. The region’s consistent affordability positions it as an attractive destination for potential homebuyers.

5. Inverclyde – £125,836

Finishing off the top five of the most budget-friendly areas, Inverclyde, in Scotland, presents an enticing average house price of £125,836. Therefore, showing Inverclyde’s commitment to maintaining affordable housing in this ever-evolving real estate landscape.

Top 20 Areas With The Cheapest Average House Prices

| Local Authority | House Price (January 2024) |

| Burnley | £100,820 |

| Hyndburn | £123,237 |

| Hartlepool | £123,710 |

| County Durham | £125,367 |

| Inverclyde | £125,836 |

| East Ayrshire | £128,549 |

| City of Kingston upon Hull | £130,908 |

| North Ayrshire | £130,943 |

| Pendle | £132,538 |

| Blackpool | £132,545 |

| Stoke-on-Trent | £135,253 |

| Sunderland | £135,666 |

| Middlesbrough | £135,894 |

| Blaenau Gwent | £136,283 |

| West Dunbartonshire | £136,668 |

| City of Aberdeen | £137,146 |

| North Lanarkshire | £138,557 |

| Blackburn with Darwen | £140,557 |

| Merthyr Tydfil | £144,376 |

| City of Dundee | £145,523 |

Top 20 Areas With The Highest Average House Prices

| Local authority | House Price (January 2024) |

| Kensington and Chelsea | £1,197,249 |

| City of Westminster | £936,715 |

| Camden | £797,248 |

| Richmond upon Thames | £747,929 |

| Hammersmith and Fulham | £724,641 |

| City of London | £715,466 |

| Elmbridge | £675,946 |

| Islington | £659,560 |

| Wandsworth | £612,612 |

| Hackney | £597,973 |

| Haringey | £579,451 |

| Barnet | £579,029 |

| Merton | £566,968 |

| Mole Valley | £565,217 |

| Three Rivers | £557,757 |

| St Albans | £553,806 |

| Windsor and Maidenhead | £541,718 |

| Kingston upon Thames | £541,019 |

| Brent | £532,273 |

| Epsom and Ewell | £531,321 |

Methodology

- The recent data around the average house price in each area of the UK was taken from the HM Land Registry from the Office for National Statistics.

- From this data we worked out the averages for the local authorities from January 2024.

- After working out all the averages, we then ranked all the areas based on their house prices.

Roof Sheet Supplier

Overall, the journey to finding an affordable home within the UK extends beyond the initial investment and area in which it is based. It is also about making a wise and sustainable choice that stands the test of time. As homebuyers explore the cheapest areas to purchase a house, it also becomes imperative to consider not only the cost of the house but also the quality of its components, with a particular focus on the roof.

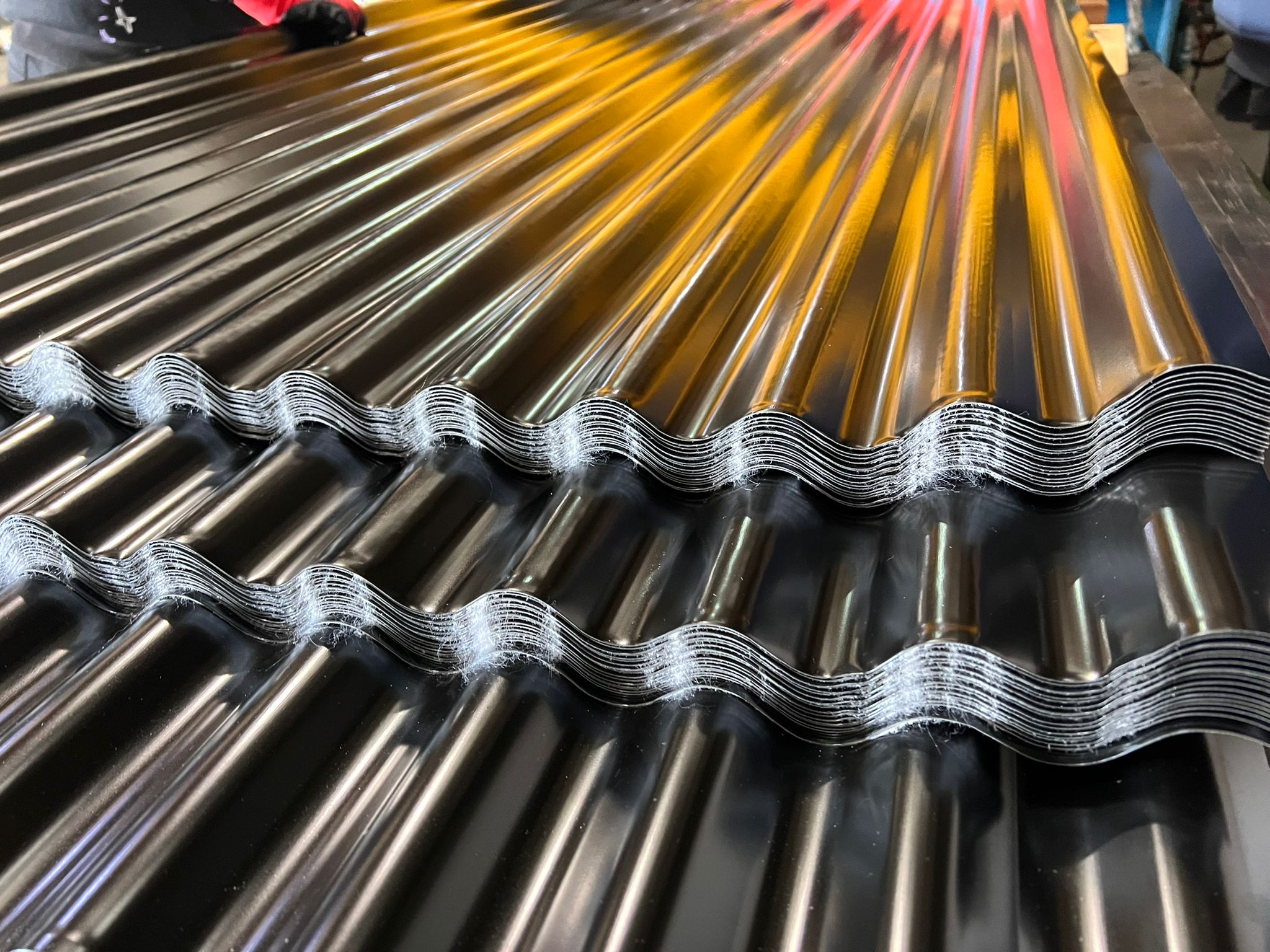

Our commitment at Cardinal Steels is to provide high-quality metal roof sheets designed to cater to a diverse range of needs across industrial, commercial, residential, and agricultural sectors. Offering a unique blend of durability, versatility, and cost-effectiveness.

Whether you’re envisioning a garden room, workshop, stable, factory, or warehouse, our metal cladding sheets stand as an ideal solution. Beyond being a practical and budget-friendly choice for garages as discussed by WM Garage Doors, steel roofing sheets symbolise a commitment to long-lasting, reliable infrastructure.

As you embark on the exciting journey of homeownership, consider not just the affordability of the house, but also the durability and resilience that a metal roof sheet brings. It’s more than a covering; it’s an investment in the future, ensuring that your home remains a haven of comfort and security for years to come. Choose affordability without compromise and let our metal roof cladding sheets be the crowning glory of your new building, providing peace of mind and protection in every season.